Homeowners Insurance in and around Lawrenceburg

If walls could talk, Lawrenceburg, they would tell you to get State Farm's homeowners insurance.

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

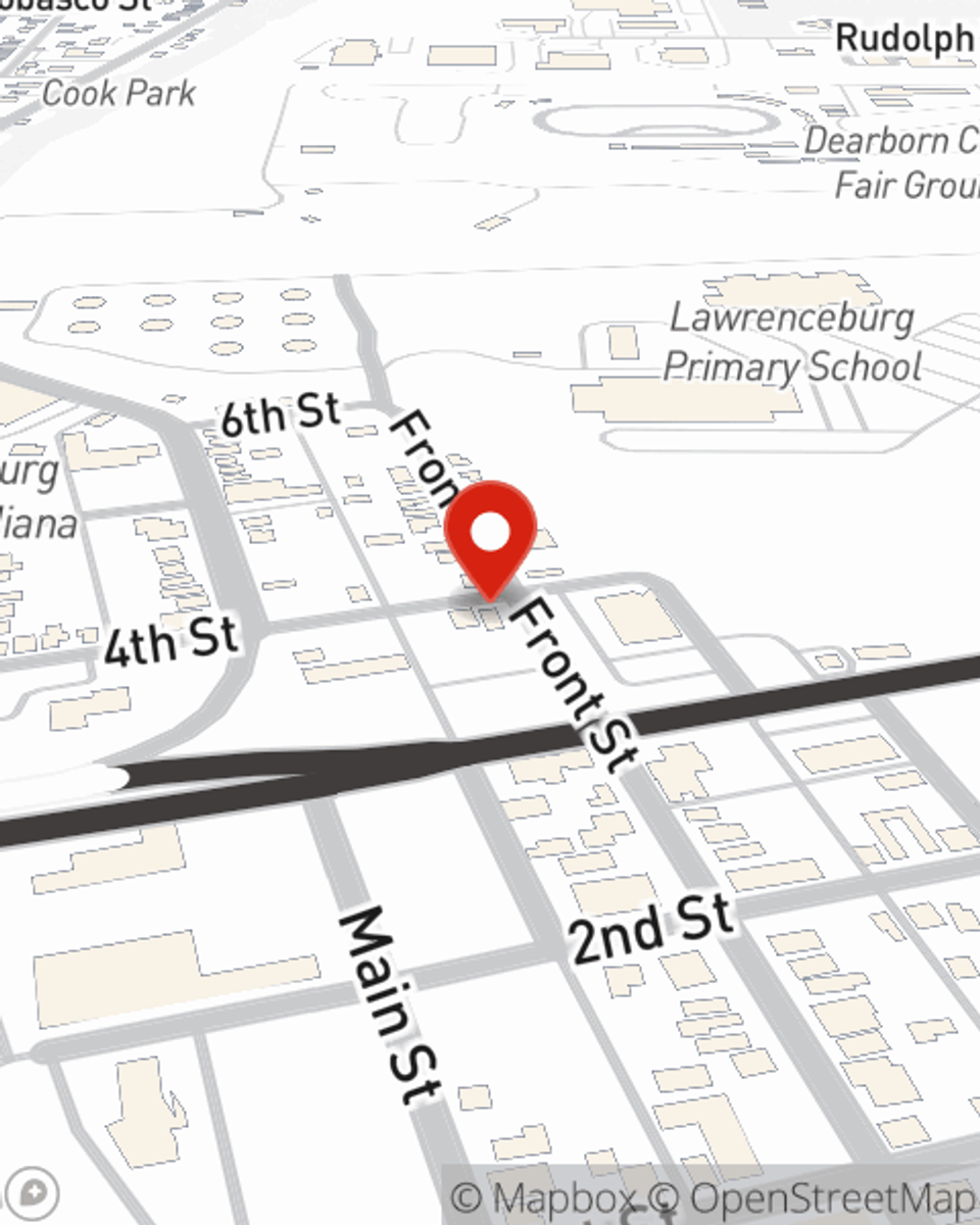

- Lawrenceburg, IN

- Aurora, IN

- West Harrison, IN

- Dillsboro, IN

- Milan, IN

- Rising Sun, IN

- Moores Hill, IN

- Versailles, IN

- Friendship, IN

- Batesville, IN

- Bennington, IN

- Napeleon, IN

- Osgood, IN

- Sunman, IN

- Dover, IN

- Brookville, IN

Insure Your Home With State Farm's Homeowners Insurance

Homeownership is a lot of responsibility. You want to make sure your home and the possessions in it are protected in the event of some unexpected mishap or accident. And you also want to be sure you have liability insurance in case someone stumbles and falls on your property.

If walls could talk, Lawrenceburg, they would tell you to get State Farm's homeowners insurance.

The key to great homeowners insurance.

Agent Danette Volpenhein, At Your Service

If you're worried about what could go wrong or just want to be prepared, State Farm's terrific coverage is right for you. Shaping a policy that works for you is not the only aspect that agent Danette Volpenhein can help you with. Danette Volpenhein is also equipped to assist you in filing a claim when troubles do come.

Lawrenceburg, IN, it's time to open the door to reliable coverage. State Farm agent Danette Volpenhein is here to assist you in creating your plan. Contact today!

Have More Questions About Homeowners Insurance?

Call Danette at (812) 577-0765 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Smart steps to ladder safety

Smart steps to ladder safety

Do you know the right ladder height for the job? Ladder-related injuries result in thousands of trips to the ER each year. Learn how to use a ladder safely.

Danette Volpenhein

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Smart steps to ladder safety

Smart steps to ladder safety

Do you know the right ladder height for the job? Ladder-related injuries result in thousands of trips to the ER each year. Learn how to use a ladder safely.